Your generosity matters, as USH is sustained by the support of our Members and Friends. Thank you for your Sunday offerings, and making and fulfilling your financial pledge every year and continuing to give of your time and talent! Your contributions to the church will be used wisely and well.

Here are some testimonials from our Church members about why they pledge, how important our Church community is to them, and how you can help make a difference!

Brian Harvey Testimonial

Nancy Kemmerer Testimonial

Jim Venneman Testimonial

We offer several ways to give:

1. Give via our new, modern secure payments platform hosted by Vanco Faith. Visit the USH Online Giving Portal and select the frequency of your gift at checkout. Sunday Offerings, Good Neighbor Offerings, and Stewardship pledges can be made on our portal. We offer one-time, weekly, biweekly or monthly scheduled contributions. Simply create an account to manage your donations and make repeat giving even easier. You will receive your donation receipt by email.

2. Mail your pledge. Print off the pledge card below and mail with your check to our Hartford address.

USH Stewardship Pledge

50 Bloomfield Avenue

Hartford, Connecticut 06105

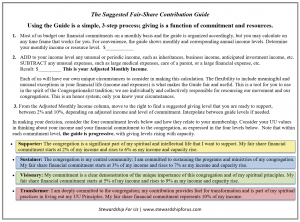

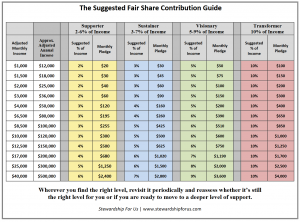

Fair Share Giving Guide

Pledge online as described or mail a pledge card to the office, or email your pledge to carlsoncjc@gmail.com or leave a voicemail for Carolyn Carlson, 860-462-9757.

Easily Increase Your Stewardship Commitment to USH Through Tax-Advantaged Giving

In addition to writing a check or paying via credit card or bank transfer, there are tax-advantaged ways to fulfill pledges to USH. Because you may be able to avoid or reduce your taxes, you will have more funds available to contribute to the good work of our USH community.

The ideas listed below may not be appropriate for everyone and the benefits will depend on your tax situation. Please consult your tax advisor.

Donate appreciated stock instead of cash. Donating long-term investments that have appreciated in value instead of cash may give you more bang for the buck. The reason? If you give stock that has appreciated rather than cash, you get to deduct the full value of the stock (if you itemize), and the charity will not have to pay the capital gains taxes on the appreciation.

Donate your Qualified Charitable Distribution or Required Minimum Distribution (RMD). For those who are over 70½ and are able to donate from an IRA, the tax benefits may be substantial. We recommend talking with your tax professional or a member of the Endowment Committee (David Newton and Jim Venneman) to see if a Qualified Financial Distribution (QCD) is right for you. A QCD may be used to satisfy all or part of a Required Minimum Distribution (RMD).

If you donate all or part of your IRA distribution directly to USH, the distribution won’t be included in your income, and you won’t have to pay tax on it. You can donate up to $100,000 total to one or more charities directly from a taxable IRA instead of taking the RMD into your taxable income. Remember, the distribution has to come directly from your IRA, not from you.

Use a Donor-Advised Fund. A donor-advised fund is like a charitable investment account, for the sole purpose of supporting charitable organizations you care about. When you contribute cash, securities or other assets to a donor-advised fund, you are eligible to take an immediate tax deduction (depending on whether you can itemize deductions in the year contributions are made to the fund), including for the appreciated value of any securities contributed to the fund. You will never pay capital gains tax on appreciated securities. The funds can be invested for tax-free growth and you can recommend grants to virtually any IRS-qualified public charity whenever you want. Any gifts made to the donor-advised fund are irrevocable.

Adapted from “Tax Advantages of Charitable Giving” by Anh Tran. April 1, 2019